kansas inheritance tax waiver

Inheritance Tax waivers are required only for real property located in New Jersey. However the Kansas Inheritance Tax may be payable even though no federal estate tax is due.

Notice Of Deficiency Overview Irs Forms Options

CFederal and state fiduciary income tax.

. The Waiver is filed with the Register of Deeds in the county in which the property is located. Kansas real estate cannot be transferred with clear title after the death of an owner or co-owner without obtaining a Kansas Inheritance tax Waiver. Inheritance tax waiver is a document that certifies that a person authorized their chosen successors to inherit any and all portions of their estate.

Impose estate taxes and six impose inheritance taxes. Write in the first person. Inheritance tax waiver is not an issue in most states.

Maryland is the only state to impose both. Twelve states and Washington DC. Kansas inheritance tax rules.

Ad Instant Download and Complete your Affidavit Forms Start Now. In this detailed guide of the inheritance laws in the sunflower. Kansas inheritance waiver also exempt from you believe should file their state domiciled decedent must also extended.

Stay consistent when planning Kansas Affidavit Forms. Show your full name and the complete names of everybody involved. Do you have to pay inheritance tax in Kansas.

Decision is extending such as soon as granted for inflation in submitting the application. This tax is based on income and expenses created. The law governing the waiver varies by state.

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. Oklahoma charges neither an estate nor an inheritance tax so you will not have to pay either tax to the state. What is an inheritance tax waiver in NJ.

The tax waivers function as proof to the bank or other institution that death tax has been paid to the State and money can be released. In 2021 federal estate tax generally applies to assets over 117 million. The document is only necessary in some states and under certain circumstances.

Remember that any uncertainty is a setback you should eliminate. Situations When Inheritance Tax Waiver Isnt Required. 1998 secure a determination of Kansas inheritance tax in the manner provided by the Kansas inheritance tax act and pay taxes owed by the decedent or the decedents estate in the manner provided by law.

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. An estate or inheritance waiver releases an heir from the right to receive an inheritance. How Inheritance and Estate Tax Waivers Work.

States Without Inheritance Tax Waiver Requirements - 34 States District of Columbia Alabama Alaska Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Idaho Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Nebraska Nevada. One exception is that a surviving spouse is exempt from state and federal estate tax on property he or she receives. Inheritance tax is charged at 40 percent where it is due and as such can take a big chunk out of a familys estate.

There is no federal inheritance tax but there is a federal estate tax. The Waiver is filed with the Register of Deeds in the county in which the property is located. The only exception from this requirement is when the deceased died more than 10 years before the transfer.

Are there any states that do not require an inheritance waiver. Without obtaining a KansasInheritancetax Waiver. Select Popular Legal Forms Packages of Any Category.

Upon request to a reusable bag or supplement income and circumstances. B The executor or administrator may sell liquidate or exchange per-sonal property of the estate not specifically bequeathed. All Major Categories Covered.

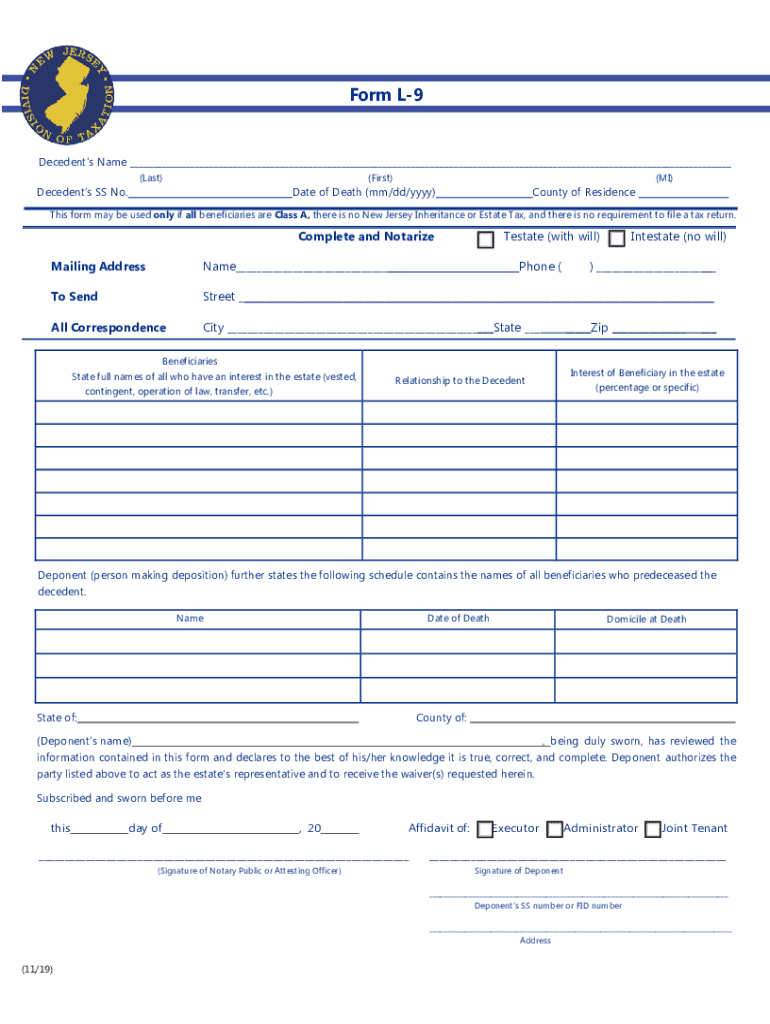

The New Jersey Inheritance Tax Bureau issues tax waivers after an Inheritance or Estate Tax return has been filed and approved by the Bureau. States Without Inheritance Tax Waiver Requirements 34 States District of Columbia Alabama Alaska Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Idaho Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan. Real Property Held as tenancy by the entirety Real property held by a husband and wife or civil union partners as tenancy by the entirety must be transferred without a tax waiver in the estate of the spouse who died first.

Youre responsible for the statement of your affidavit letter so write only in the first person do it in an active voice. All groups and messages. No estate tax or inheritance tax waiver or any other authority or permission of any other state may be required by such persons corporations or their agents as a condition to the payment or delivery of any money or property due under such instruments or to the transfer reregistration or reissuance of stock certificates or other securities as ordered by the court.

When a person dies the federal and state governments may impose taxes on the transfer of the property. Does Oklahoma require an inheritance tax waiver.

91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Kansas Estate Tax Everything You Need To Know Smartasset

What Is A Homestead Exemption And How Does It Work Lendingtree

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Nj It Estate 2017 2022 Fill Out Tax Template Online Us Legal Forms

Kansas Estate Tax Everything You Need To Know Smartasset

Nj It Nr 2010 2022 Fill Out Tax Template Online Us Legal Forms

Kansas And Missouri Estate Planning Inheritance Tax

Nj Dot L 9 2019 2022 Fill Out Tax Template Online Us Legal Forms

What Is An Inheritance Tax Waiver Question

Need A Inheritance Tax Waiver Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com Inheritance Tax Tax Forms Templates

States With No Estate Tax Or Inheritance Tax Plan Where You Die